PM Youth Business and Agriculture Loan Scheme

The PM Youth Business & Agriculture Loan Scheme 2025 is a government initiative. It supports young entrepreneurs in Pakistan to start or grow businesses. The scheme is part of the Kamyab Jawan Program. Its goal is to reduce unemployment and promote economic growth. It provides low-interest and interest-free loans for startups and existing businesses. Sectors include IT, e-commerce, agriculture, and manufacturing. The scheme is open across all regions, including Gilgit-Baltistan and AJK.

The loan program is simple and inclusive. Women, transgender individuals, and people with disabilities are encouraged to apply. It also includes a new Tier-4 for laptops and overseas work expenses. The process is fully online and transparent. Applicants can track their application via SMS. The government ensures minimal collateral and flexible repayment options to make entrepreneurship accessible.

Key Features of PM Youth Loan 2025

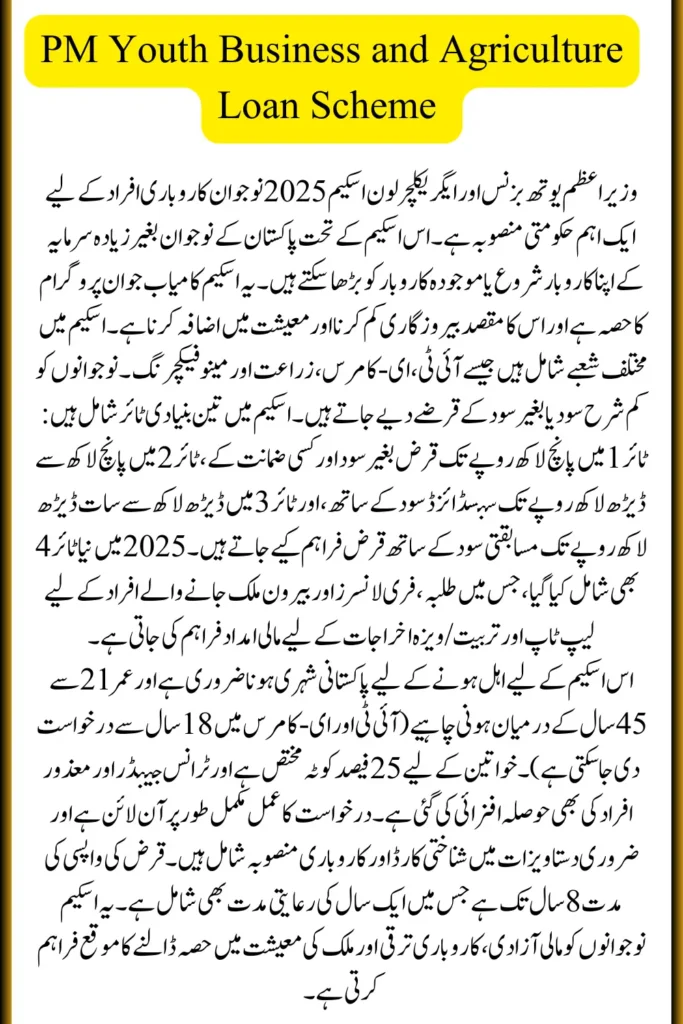

The scheme offers a tiered loan structure for different needs:

- Tier 1: Up to Rs. 500,000, interest-free, no collateral

- Tier 2: Rs. 500,000 to Rs. 1.5 million, subsidized interest

- Tier 3: Rs. 1.5 million to Rs. 7.5 million, competitive interest

- Tier 4: Laptops for students/freelancers, and overseas work financing

Loans come with flexible repayment up to 8 years. A one-year grace period is included. New businesses provide 10% equity, while existing businesses need none.

| Tier | Loan Amount | Interest Rate | Collateral |

|---|---|---|---|

| 1 | Up to 500,000 | 0% | No |

| 2 | 500,000–1.5M | Subsidized | Minimal |

| 3 | 1.5M–7.5M | Competitive | Required |

| 4 | Laptops/Overseas | Subsidized | No |

Eligibility Criteria

Applicants must be Pakistani citizens with a valid CNIC. Age limit is 21–45, with 18+ allowed for IT/e-commerce. Both new and existing businesses are eligible. Education is not required for Tier 1, but experience helps.

BISP 8171 Digital Payment Model Improves Assistance Check Now

Eligibility also ensures inclusion. Women have a 25% quota. Transgender individuals and people with disabilities are encouraged. The scheme is available nationwide, making it accessible to everyone.

Required Documents for Online Application

Applicants need CNIC and a business plan. Scanned copies of all documents are required. Ready-made feasibility reports for over 200 business ideas are available online. Clear financial estimates improve approval chances. Proper documentation ensures smooth processing.

How to Apply Online

Step 1: Visit the official PMYP website. Step 2: Select “Youth Business and Agriculture Loan Scheme.” Step 3: Start the application by entering your CNIC and mobile number. Step 4: Fill in personal, business, and financial details. Step 5: Upload documents and review carefully. Step 6: Apply.

After submission, a tracking ID is sent via SMS. The bank may verify details and visit the home or business. Approval usually takes 30–60 days. Funds are transferred directly to the applicant’s bank account.

Tips for a Successful Application

- Prepare a strong business plan

- Use realistic financial estimates

- Double-check all details before submission

- Keep contact information accurate

These tips increase approval chances and speed up processing. Realistic plans show credibility and commitment.

FAQs

Who can apply for the PM Youth Business & Agriculture Loan Scheme 2025?

Pakistani citizens aged 21–45 with new or existing businesses can apply.

How much loan can I get under the scheme?

Loans range from Rs. 500,000 to Rs. 7.5 million depending on the tier.

What is the repayment period?

Repayment can be up to 8 years, including a one-year grace period.

Can women and disabled individuals apply?

Yes, 25% quota is for women, and the scheme encourages disabled applicants.

What is Tier-4 and who benefits?

Tier-4 provides laptops and financing for overseas work to students, freelancers, and entrepreneurs.

BISP 8171 Easypaisa and JazzCash Payment December 2025: Complete Guide