PMYP Loan 2025

The PMYP Loan Scheme 2025 is a government-backed initiative under the Prime Minister’s Youth Program, designed to support unemployed youth in Pakistan. This scheme offers both interest-free and low-interest loans to help young individuals start or expand their own small businesses. With a simplified online application system, the program is now more accessible than ever, making it easier for skilled and unemployed youth to take their first step toward entrepreneurship.

The aim of PMYP Loan 2025 is to reduce unemployment, support self-employment, and encourage youth-led startups across sectors like agriculture, trade, manufacturing, IT, and digital services. Through this scheme, the government is giving young people the opportunity to turn their business ideas into reality without being burdened by high-interest rates or complex banking procedures.

CM Punjab Laptop Scheme 2025 Complete Guide for Students Registration and Benefits

What is the PMYP Loan Scheme 2025

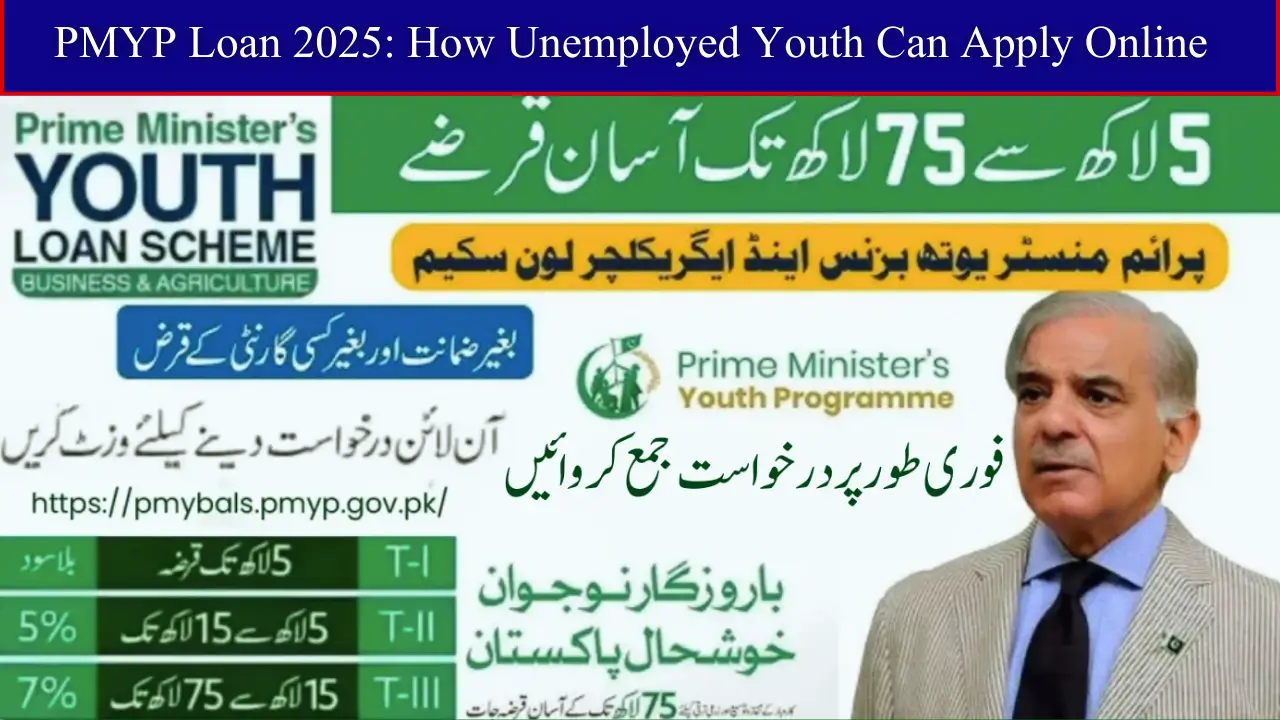

The PMYP Loan 2025 is a financial assistance program offering business loans to the youth of Pakistan. It targets unemployed graduates, skilled individuals, and aspiring entrepreneurs who want to start or grow a business. Loans are offered in three tiers, depending on the amount and type of business. From small interest-free loans to larger low-interest ones, the scheme aims to promote economic development through self-sufficiency.

This initiative also supports underrepresented groups, including women, transgender individuals, and residents of rural areas. The online nature of the program allows people from all parts of the country to apply without having to visit bank branches or government offices.

PMYP Loan Tiers and Amounts

The PMYP Loan Scheme 2025 is divided into three tiers to accommodate various business needs.

- Tier 1 offers interest-free loans up to 500,000 rupees.

- Tier 2 provides loans from 500,001 to 1.5 million rupees with a 5 percent interest rate.

- Tier 3 includes loans from 1.5 million to 7.5 million rupees with a 7 percent markup.

These loan tiers allow individuals to apply based on their business scale, whether they want to start a small roadside business or launch a full-scale startup.

Eligibility Criteria for PMYP Loan

The government has set clear eligibility requirements to make sure the right individuals benefit from this program.

- You must be a Pakistani citizen with a valid CNIC.

- Your age should be between 21 and 45 years. For IT-related businesses, the minimum age is 18.

- You must have a viable business plan or already own a small business.

- You should not be in default of any previous bank loan.

- Special preference is given to women, transgender individuals, and people from rural areas.

If you meet these conditions, you are eligible to apply for this loan and take the first step toward becoming self-employed.

Register Yourself in The Ehsaas Program Using Your ID Card

Documents Needed to Apply

The loan application process is easy, but preparation is important. Make sure you have the following documents ready before applying online

- A valid CNIC.

- A recent passport-size photo.

- Educational certificates if available.

- A clear and realistic business plan.

- Business registration or income proof (optional but helpful).

You are still eligible even if you do not have a formal education. A strong and well-written business plan increases your chances of approval.

How to Apply for the PMYP Loan Online

Applying for the PMYP Loan Scheme 2025 is completely online and simple to follow. Here are the steps you need to complete

- Go to www.pmyp.gov.pk.

- Click on the Apply for Loan button.

- Register using your CNIC and mobile number. You will get an SMS verification code.

- Fill out the application form with personal, educational, and business details.

- Choose the appropriate loan tier and upload all necessary documents.

- Select your preferred partner bank such as NBP, HBL, BOP, or others.

- Review your application and click Submit.

After submission, you can track your application status directly on the website or through the PMYP mobile app.

Tracking Your Loan Application

Once you’ve applied, it is easy to check the status of your application. Simply log in to the PMYP portal using your CNIC and password. Go to the Application Status section to view updates on your submission. You’ll be able to see if your application is under review, approved, or if more information is required.

Special Quota for Women and Rural Youth

One of the most inclusive features of the PMYP Loan 2025 is its focus on equality. A special 25 percent quota has been reserved for women applicants to encourage female entrepreneurship in Pakistan. The scheme also prioritizes rural applicants and those from underprivileged areas, giving everyone an equal chance to succeed.

Training and Support for PMYP Applicants

PMYP does not just offer money; it also supports your business journey with free training and planning resources. SMEDA provides free business plan templates, training materials, and one-on-one advisory services. NAVTTC also offers technical and entrepreneurship training across various sectors. These resources are especially helpful for first-time business owners who need guidance.

Issuance Of BISP Mazdoor Card By Benazir Income Support

Tips to Get Approved Faster

- Write a detailed and realistic business plan.

- Upload clear and properly scanned documents.

- Select a loan tier that matches your business size.

- Choose a reliable partner bank.

- Check your application status regularly and respond to any updates or issues.

Advantages of the PMYP Loan Scheme 2025

- Interest-free loans for up to 500,000 rupees.

- Loans up to 7.5 million rupees for bigger ventures.

- No requirement for previous business experience.

- Online application from anywhere in Pakistan.

- Fast NADRA e-verification for quicker processing

- Free training and business planning support from SMEDA and NAVTTC.

PMYP Helpline and Support Contacts

For any help regarding your loan application, you can reach out to PMYP support at

- Phone 051 9203585 or toll-free 0800-77000.

- Email complaint@pmyp.gov.pk.

- Visit the official site www.pmyp.gov.pk.

For business planning support, you can also contact SMEDA at 042-111-111-456 or check their website for regional offices

Helpline 1312 Launched for Himmat Card: Support for Special Persons in Need

Conclusion

The PMYP Loan Scheme 2025 is a golden opportunity for unemployed youth in Pakistan to start their own businesses and achieve financial independence. With a simple online process, government support, and zero to low interest rates, this program makes entrepreneurship more accessible than ever.

Whether you want to open a shop, launch a tech startup, or grow your existing business, this loan can be your first step. If you are eligible, do not wait. Apply now and turn your business dreams into a reality.

FAQs

Who can apply for the PMYP Loan 2025?

Pakistani citizens aged 21 to 45 with a valid CNIC and a strong business plan. For the IT sector, the minimum age is 18

How much loan can I get?

You can apply for loans between Rs. 500,000 and Rs. 7.5 million, depending on your business size and plan

Is formal education required?

No, formal education is not necessary. A strong business plan is more important

Can women apply for this loan?

Yes, 25 percent of the total quota is reserved for women to support female entrepreneurship

Where can I apply?

You can apply online at www.pmyp.gov.pk

or through the PMYP mobile application

How long does approval take?

Thanks to NADRA e-verification, most loan applications are processed within 15 to 25 working days

Does the government offer any training?

Yes, both SMEDA and NAVTTC provide free training and business development resources to PMYP applicants

What sectors are eligible under PMYP?

You can apply for businesses in agriculture, trade, IT, services, manufacturing, and more.

Pakistan’s Solar Panel Industry to Receive Major Update in September 2025