State Bank Mera Ghar Mera Ashiyana Scheme

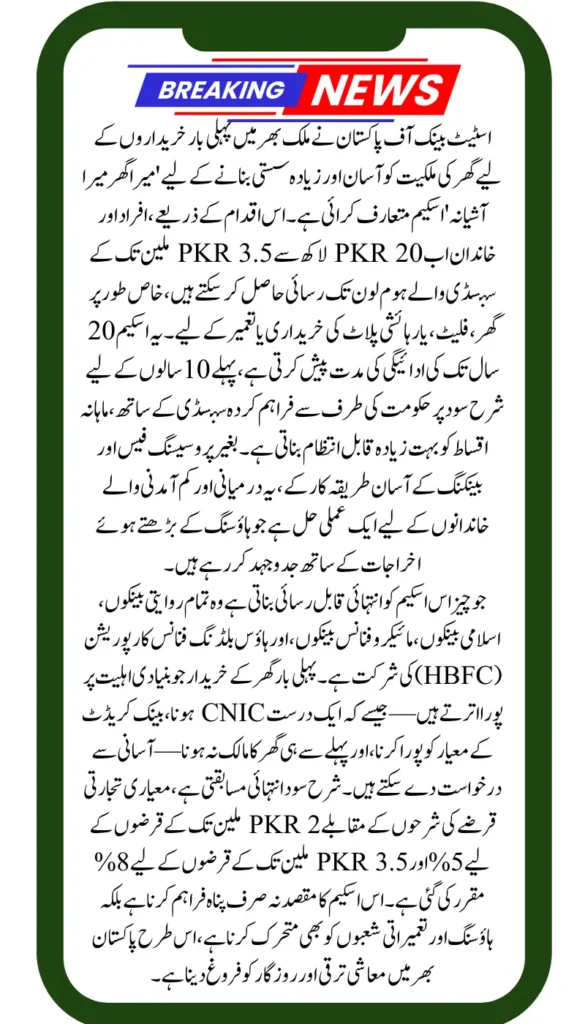

In a major step towards making housing more affordable in Pakistan, the State Bank of Pakistan (SBP) has officially launched the ‘Mera Ghar Mera Ashiyana’ scheme. This initiative is designed especially for first-time home buyers who want to purchase or build their own house, flat, or plot. With rising real estate prices and limited financing options, this scheme provides an excellent opportunity for middle- and lower-income families to turn their dream of owning a home into reality.

Let’s take a closer look at the features, eligibility, benefits, and how you can apply for this scheme.

How to Get Free Solar Panels For Ineligible Families In BISP

What is the ‘Mera Ghar Mera Ashiyana’ Scheme?

The ‘Mera Ghar Mera Ashiyana’ scheme is a home financing program launched by the State Bank of Pakistan to support individuals and families who are buying or constructing a home for the first time. The scheme offers subsidized loans ranging from PKR 2 million to PKR 3.5 million, with easy repayment options spread over 20 years.

This initiative not only makes it easier to access financing but also reduces the financial burden through government-provided subsidy for the first 10 years.

Key Features of the Scheme

Here are the main highlights of the Mera Ghar Mera Ashiyana scheme:

- Loan Amount: From PKR 2 million to PKR 3.5 million

- Loan Tenure: Up to 20 years

- Subsidy Duration: Applicable for the first 10 years

- Interest/Markup Rates:

5% for loans up to PKR 2 million

8% for loans up to PKR 3.5 million

- Pricing Model: KIBOR + 3% (standard pricing model)

- Zero Processing Fee: No hidden charges for application or loan processing

- Loan Usage: Can be used for purchase or construction of house, flat, or plot

KPK Govt Has Increased The Health Card Budget By 3 Billion Rs

Who Can Apply – Eligibility Criteria

To qualify for this scheme, you must meet the following conditions:

- First-Time Home Buyer: You should not already own a home.

- Loan Range: The property value must be within the approved loan range (PKR 2M to PKR 3.5M).

- 🇵🇰 Must be a citizen of Pakistan with valid CNIC.

- Meet the bank’s credit and income criteria (varies per bank).

This scheme is open to both salaried and self-employed individuals, subject to bank requirements.

Where Can You Get the Loan?

The scheme is supported by a wide network of financial institutions. You can apply through:

- All Conventional Banks

- Islamic Banks

- Microfinance Banks

- House Building Finance Corporation (HBFC)

This wide participation ensures easy accessibility across both urban and rural areas.

Loan Pricing & Interest Rates

The loan markup rates under the scheme are highly competitive:

- Up to PKR 2 million: 5% fixed interest

- Up to PKR 3.5 million: 8% fixed interest

- After the 10-year subsidy period, standard pricing will be KIBOR + 3%

This makes your monthly installments more predictable and manageable during the early years.

Punjab E-Taxi Scheme 2025: Portal Launch, Qualification Criteria and Application Process

How to Apply – Step-by-Step Guide

While specific bank procedures may vary, here is a general guide to applying:

- Visit your nearest participating bank branch (Conventional or Islamic)

- Fill out the home loan application form

- Submit required documents CNIC, proof of income, property documents, etc.

- Bank reviews application and verifies eligibility

- Upon approval, loan is disbursed directly to the property seller or builder

Online portals may also be available through your bank for initial application or inquiries.

Why This Scheme Matters – Key Benefits

- Helps families own a home without needing a massive upfront investment

- Offers long-term loans with low markup rates

- Reduces financial burden through government subsidy

- No processing fees or hidden charges

- Boosts economic growth and employment through the construction sector

- Available through both conventional and Islamic banking channels

Empowering Punjab’s Farmers Historic Expansion of Kisaan Card Benefits for Kharif 2025

Final Words

The ‘Mera Ghar Mera Ashiyana’ scheme by the State Bank of Pakistan is a powerful initiative aimed at solving Pakistan’s housing challenges. By offering low-interest, long-term loans with zero processing fees, it opens the doors to homeownership for thousands of families across the country.

If you or someone you know is looking to buy or build their first home, this is a golden opportunity you shouldn’t miss. Visit your nearest bank today and take the first step toward owning your dream home.

Frequently Asked Questions

Who is eligible for the scheme?

Only first-time home buyers in Pakistan are eligible.

What can the loan be used for?

For purchasing or constructing a house, flat, or plot.

What is the maximum loan amount?

Up to PKR 3.5 million.

Is this loan available through Islamic banking?

Yes, both conventional and Islamic banks are part of the scheme.

Is there any processing fee?

No, the loan has zero processing charges.

BISP 8171 Information: 13500 Phase III: Registration Updates and Latest News